|

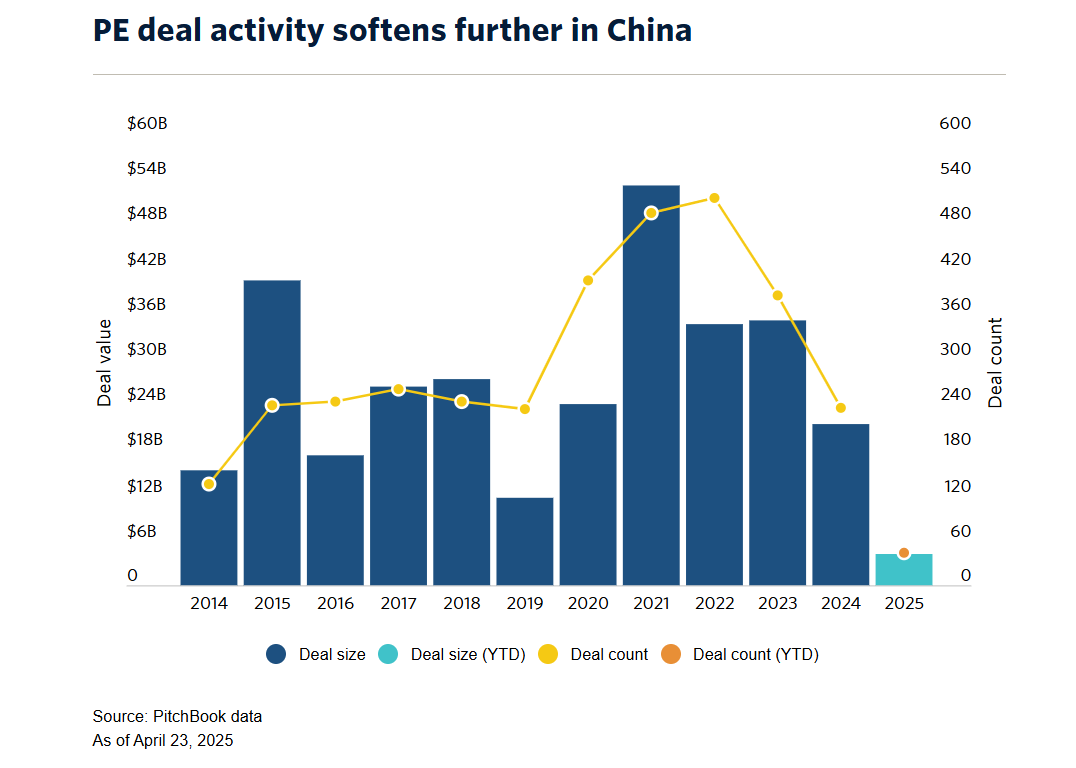

Permira is closing its Hong Kong and Shanghai offices to focus on high-growth opportunities in India. Global investors have cooled on China due to geopolitical risks and its slow economic recovery after COVID-19. The UK-based firm currently has five offices in APAC—Mumbai, Seoul and Singapore will remain after the Greater China offices close. According to the company’s website, it currently holds four investments in APAC, including China-based online commercial freight platform Full Truck Alliance, Hong Kong-based aquatic feed producer Grobest, Hong Kong-based aviation support services provider Topcast and Australia-based diagnostic imaging services provider I-Med Radiology Network. It will take around 18 months for the offices to wind down. rivate The Greater China office closure is part of Permira’s strategic shift to India. “When we look at the APAC region today, India stands out as the market where our platform has an edge. The combination of world-class talent, powerful consumption trends and a fast-growing cohort of digital-first businesses is well-aligned with Permira’s investing model,” Dipan Patel, co-CEO of Permira told PitchBook News. “We are focused on backing companies that are riding secular growth trends that are consistent with our transatlantic investment strategy—and India has an abundance of them.” The trade war between China and the US has brought added uncertainty to the Chinese Private Equity market, which has already seen its dominance diminish. Earlier this month, the US levied a 145% effective rate on Chinese goods, which led to China retaliating with a 125% tariff for US imports. As of April 23, US President Donald Trump said in the latest White House news conference that the tariffs on China will “come down substantially, but it won’t be zero”. It remains to be seen how much impact the tariff will have on China, which has already seen a significant slowdown in private market activities in the last three years. Private Equity deal value in China fell 40% year-over-year in 2024 to $21.4 billion, reaching only 40% of 2021’s peak. Deal activities slowed even further this year with only $4.2 billion transacted so far, accounting for around 20% of last year’s total. Story by Emily Lai, a London-based reporter for PitchBook covering private equity across Europe and the Middle East. For the full story, click here.

0 Comments

Leave a Reply. |

Mike townerOver 5 decades of trying to keep up with technology! ArchivesCategories

All

|

RSS Feed

RSS Feed